I’m currently looking into creating a report on

Bodycote’s shares and see that they have what they call a strategic outpost in

India. They announced their expansion into the country in 2006 near one of its

automotive hubs in the western region of India in Pune. I thought it could be

interesting to have a quick initial look at this large emerging market. I’ll be

getting a lot of information via internet searches from various internet

websites which I will try to mention throughout this post. I will not be

verifying this information at this stage so there could be large inaccuracies

contained in my rough initial overview. I hope over time that I can improve

this overview as it is an important growing market for the heat treating

industry.

ASM International’s Chennai Chapter provides an

estimate of the size of the Indian heat treating market on the website for “Heat

Treat & Surface Engineering Conference & Expo 2013.” This is at USD 1bn

+ with a growth rate of 12% per annum. Bodycote has estimated the size of the

global heat treating market at USD 35bn (of which around USD 20bn is in the US)

which would suggest that the Indian market is a significant one globally (so a

super rough estimate would be almost 3% of the global market if these figures are

correct). When DOWA raised its stake in Hightemp Furnaces in 2011, it also

estimated growth of the Indian heat treating industry to be at a rate of

approximately 12% per annum to 2015. I unfortunately don’t yet have an estimate

of captive vs. commercial for the Indian market although, in a 2012 interview

with The Monty Heat Treat News, Hightemp Furnaces indicated that the captive

market was larger than the commercial but that this scenario was changing

rapidly.

What’s the Key Driver?

The long term rise of India as a leading

emerging economy is a well known theme. As GDP continues to grow and investment

in infrastructure is made, the automobile industry has huge potential. The

growth of the Indian automotive industry is providing the demand for most heat

treating activities. There are four main hubs and a newer growing 2nd

hub in the west of the country. The industry has experienced a boom in recent

years with a 6yr CAGR of 13.1%

Figure

1: Historical Auto Production

* Compound Annual Growth Rate, year end is in March for these figures Source: SIAM

A large segment of this production is of 2- and

3-wheelers but the market share of 4 wheelers is expected to rise over time.

Forecasts from the Society of Indian Automobile Manufacturers (SIAM) show

tremendous growth in passenger vehicles over the next decade, with a CAGR to

March 2021 of 13%.

Figure 2: Passenger Vehicle Production and

Forecasts

Note: Year end is in March for these figures, F = Forecast Source:

SIAM

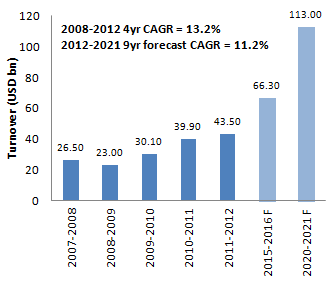

The growth in automobile manufacturing has also

driven impressive growth in the auto component industry as the following data

from The Automotive Component Manufacturers Association of India (ACMA) show.

Figure 3: Auto Component Industry Turnover and

Forecasts

F = forecast Source:

ACMA

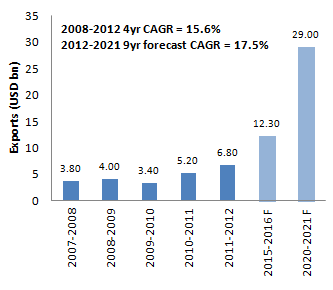

Indian auto component exports are also

interesting to show as ACMA forecasts these to grow considerably with Europe

accounting for the largest export destination currently (36%).

Figure 4: Auto Component Exports and Forecasts

F = forecast Source: ACMA

Other sectors could also be expected to also

make an impact on the heat treating industry in the future but for the moment

the automobile industry is the dominant factor in India.

Who are the Key Players?

Hightemp Furnaces (DOWA) - http://www.hightemp-furnaces.com/

In 2011, DOWA Thermotech (the world’s 4th

largest heat treater and a unit of Japanese conglomerate DOWA Holdings)

expanded their stake in this company to 80% from 16.1%. Hightemp builds

furnaces as well as providing heat treatment services (as does DOWA elsewhere).

Their website states that they are the largest 3rd party commercial heat

treatment company in India with an approximate market share of 40% in

industrial heat treatment furnaces.

At the time of the transaction the Nikkei

estimated the deal value to be Rs 1.9bn and for 2011 net sales to have been Rs

950m. This would give a EV/Sales multiple of 2.0x (slightly higher than the

approximate 1.95x multiple Bodycote paid for CCHT in the US in 2012 although

this was a multiple paid for a company without furnace building operations).

With this transaction, DOWA targeted to grow

its Indian operations through not only its traditional Japanese client base but

also through local and foreign affiliated auto manufacturers (ie Hightemp

Furnaces client base). This could be a shrewd move as Figure 5 shows an ACMA

estimate of the presence of global manufacturers illustrating a more significant

US and European presence, although Japanese manufacturers remain highly active.

Figure 5: Growing presence of Global OEMs –

Passenger Car

Source: ACMA (from

their illustrative list of auto manufacturers)

Hightemp Furnaces’ website states that it

offers heat treatment services aggregating over 1,500 tons per month for 300+

customers and has an installed infrastructure base that includes 40 furnaces (although

in a July 2012 interview with The Monty Heat Treat News the President of

Hightemp states that the company have 62 operational furnaces). The company has

5 plants, 4 of which offer heat treatment services, situated in the north, west

and south of the country.

While Hightemp Furnaces was easy to find, the

rest have been less so I expect to have made significant omissions. Here’s a list

of some of the more eyecatching companies offering heat treatment services that

I came across.

Metals India - http://www.metalsindia.com/

Metals India was established in 1979 and its

website states it can now process approximately 1,000 tonnes of materials per

month. Metals India’s activities support the Automotive, Tool & Die,

Exports, Railway, Aerospace, Defence, Surgical, Plastic and general Engineering

industries. The firm is located in Faridabad in the north of the country (close

to New Delhi). In a 2012 article, The Economic Times of India stated that there

were approximately 20 heat treatment units in Faridabad (mostly small players).

Looking at the company’s profile via the Indiamart website shows an annual

turnover of approximately USD 2 – 5m. From the Indiamart profile Metals India clients

include GM and Honda.

Heat Treaters and Engineers http://www.heattreatersindia.com/index.htm

This company was also established in 1979 and

now has a staff of 35 people. The company is located in the East of the country

with plants at Ahmedabad and Baroda. The company focuses on induction hardening

and tempering, toughing, stress relieving, annealing, normalizing, stabilising,

gas nitriding and gas carburising. A quick count shows 13 furnaces at Ahmedabad

and 5 furnaces as Baroda (so 18 in total). The company’s client list appears to

show mostly local customers.

Therelek Engineers http://www.therelek.com/

Builds and services furnaces as well as

providing heat treatment services. The company states that it is the first and only

commercial heat treater in the company with NADCAP accreditation (In my search

I have seen that Hightemp’s Peenya plant received NADCAP accreditation in

2012). It is the only company that I have seen so far whose heat treating

services is largely focussed on the aerospace sector. The website states that

customers include OEM suppliers to Whitney, Pratt, Mc Donald, Rolls Royce,

Airbus and Boeing.

There are many small players and their remains

limited information on websites to assess size and importance of companies in

the market. I will conduct another search of the Indian market later this year

to see if there are any significant omissions.

International Players in the Market (ex-DOWA)

Bodycote (UK)

In a 2006 press release, Bodycote announced the

launch of an initial investment in Pune stating that it would be the largest full

service commercial heat facility in India. The company also planned to open up

a further 5 facilities by 2011 to service the main manufacturing regions. The

Economic Times of India reported that Bodycote planned to have 10 facilities in

India in the next ten years (therefore by 2016). In 2007 Bodycote acquired the

heat treatment business of Ionbond in India. Presently, Bodycote’s website shows

one location in Pune. In its 2007 preliminary results presentation, Bodycote

showed that it had 3 heat treatment operating locations in India, possibly

suggesting that some operations were closed down in the restructuring program

that the company has implemented in recent years. In its Capital Markets Day

presentation in 2011, emerging markets were a key area of growth and focus for

the company but much of this future expansion was to be in China (and some

Eastern Europe). Plans for the Indian operations were to add high-value sales

and incremental capacity. This would give the impression that the company will

not make large inroads into the Indian market in the short term.

Aalberts Industries (NL)

Aalberts has a presence with its Industrial

Services division in the west of the country but I cannot see anything to

suggest they have heat treating operations there. It would seem that Hightemp

Furnaces shows TTI Group (a division of Aalberts) as a partner, which would

suggest that they are licensing surface treatment technology from TTI. In my

initial look at the Indian market I see no indications as yet that they would

expand into heat treating operations here, although with Aalberts insisting

cross-selling is a continuing focus it could mean that more Industrial Services

offerings (including heat treating) might be introduced in India in the long

term.

Nihon Parkerizing (JP)

Their Indian website includes a “President

Massage” in the company section so I am not too sure how serious they are in

expanding into India. From their regional headquarters page, it looks like the

company provides surface treatment services in the country but no heat

treatment services as it does in Indonesia for example.

That rounds up my quick look at the Indian heat

treating market. I hope to visit this topic again and in more detail later this

year. If you see any inaccuracies, please let me know – I am conducting all my

research using internet sources so there could be errors.